- As interest rates return towards neutral, we expect them to settle at higher levels than in the 2010s.

- US economic resilience is more a result of good luck rather than monetary policy, in our view.

- Economic developments could expose the vulnerability of stretched equity valuations.

While the era of sound money lives on, with interest rates above the rate of inflation, markets face a growing point of tension as assets with the strongest fundamentals have the most stretched valuations, and vice versa.

That’s one of the key messages in Vanguard’s 2025 economic and market outlook, in which our economists look beyond the impact of monetary policy, including revised expectations for growth, inflation, interest rates and long-term asset return expectations.

Cutting to the chase

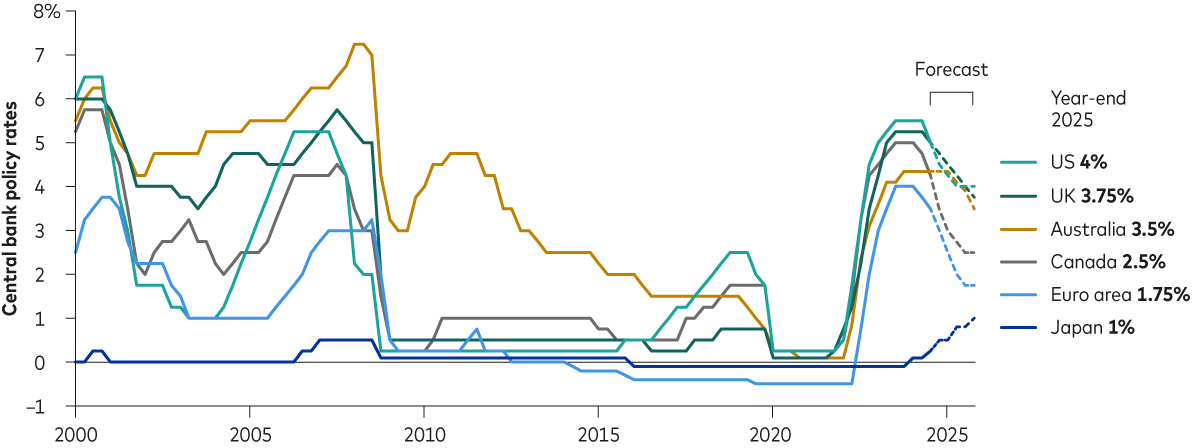

After two years of sharp inflation declines across developed markets, central banks are finally nearing their inflation targets of 2%. We expect central banks to continue cutting rates gradually in 2025 but we believe that policy rates will settle at higher levels than in the 2010s.

This structural theme holds even if central banks cut rates below neutral in the short term to alleviate temporary growth concerns. The era of sound money— characterised by positive real interest rates—will endure, setting the foundation for solid fixed income returns over the next decade.

Most policy rates will likely settle lower but above inflation

Notes: The chart shows central bank’s nominal monetary policy rates for each quarter until 4 November 2024 and forecasts thereafter. Most major central banks have target rates around 2%.

Sources: Vanguard calculations, using data from Macrobond, as at 4 November 2024.

Good luck can explain US economic resilience more than Fed policy

Against the backdrop of restrictive monetary policy, the US economy has had the favourable combination of strong real GDP growth, the loosening of overly tight labour markets and falling inflation. It may be tempting to attribute this good fortune to a ‘soft landing’ engineered by the US Federal Reserve. However, a closer look suggests that this interpretation may be insufficient.

Rather, continued US robustness may owe more to fortuitous supply-side factors, including higher productivity growth and a surge in available labour. Higher output and lower inflation can generally coexist only when the supply-side forces are in the driver’s seat. These dynamics have altered our baseline US economic outlook and point to the primary risks on the horizon.

While the positive supply-side drivers of growth may continue in 2025, emerging policy risks such as the implementation of trade tariffs and stricter immigration policies may offset gains. Under such a scenario, US real GDP growth would cool from its present rate of around 3% to closer to 2%.

Divergent paths for euro area and UK economies

Economies outside of the US have been less lucky on the supply side, and thus unable to achieve the same combination of strong growth alongside significantly reduced inflation. While inflation is now close to target in Europe, that has come at the price of stagnation in 2023 and 2024, with muted external demand, weak productivity and the lingering effects of the energy crisis holding activity back. Growth is expected to remain below trend next year, as a slowdown in global trade represents a key risk. We expect the European Central Bank to cut rates below neutral, to 1.75%, by the end of 2025.

On the other hand, in the UK, we forecast growth to rise above trend in 2025, given the expansionary Autumn Budget. We are expecting the Bank of England to follow a more hawkish easing cycle, with rates ending 2025 at 3.75%.

In China, policymakers still have work to do despite their coordinated policy pivot to both easier fiscal and monetary policy in late 2024. Growth should pick up in the coming quarters as financing conditions ease and fiscal stimulus measures kick in.

Growing market tension

US equities have delivered strong returns in recent years, with 2024 seeing robust earnings growth and elevated price/earnings ratios. US valuations look stretched and this is a growing point of tension in markets.

While valuations are high, they are supported by low financing costs pre-2022 and a market concentration in growth sectors like technology. Looking ahead, we see three potential scenarios: a productivity boom could sustain high valuations, lower interest rates could spark a rotation into undervalued sectors or an economic downturn could expose market vulnerabilities.

Over the long term, stretched valuations and high profit margins are expected to pose significant challenges to US equity returns.

Reasonable returns across the risk spectrum

Our latest market return expectations suggest diversified multi-asset investors can achieve reasonable long-term returns across the risk spectrum, with higher bond-allocation portfolios offering better risk-adjusted returns.

Read the full report to find out how our long-term asset return expectations have changed, including for multi-asset portfolios.

Watch our 2025 economic and market outlook webinar on demand for further insights, including a Q&A with Vanguard economists.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.