- After a period of stagnation, the euro area and the UK have shown signs of economic recovery.

- Headline inflation is likely to settle at target levels around the end of 2024, while core inflation may take longer to come down to target.

- Central banks in the euro area and the UK are expected to cut interest rates in 2024.

"The last mile of the fight against inflation is proving challenging."

Head of Investment Strategy Group and Chief Economist, Europe

After months of stagnation, the euro area and the UK have finally started to grow again. The European Central Bank (ECB) has already started easing its monetary policy, and the Bank of England (BoE) may not be far behind. But future cuts will depend on continued progress in the fight against inflation.

The euro area economy expanded by 0.3% and the UK economy grew by 0.6% in the first quarter of 2024 compared with the fourth quarter of 2023, breaking the recent trend of slow or negative growth. This uptick was driven by recovering real household incomes and an improved outlook for the global economy, which helped boost exports and reignite business confidence. We expect growth to continue for the rest of the year, driven by further gains in real incomes and easing financial conditions, though we expect activity to be restricted by still-weak manufacturing.

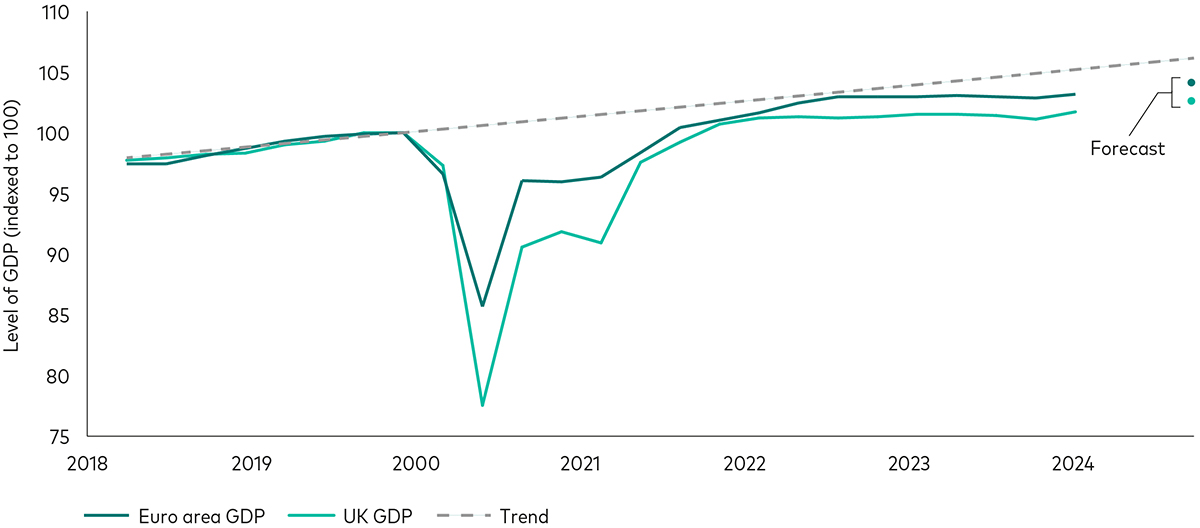

The euro area and the UK have recovered but are likely to remain below pre-Covid trend

Sources: Vanguard calculations using data as of 10 June 2024, from Eurostat and the Office for National Statistics. Vanguard forecasts thereafter. Notes: The solid lines show real GDP for the euro area and the UK indexed to 100 as of the fourth quarter of 2019. The dotted line shows the pre-Covid trend for both economies. The two dots are Vanguard forecasts for the end of 2024.

The last mile of the fight against inflation is proving challenging. Inflation in the energy, food and core goods components is now closer to the long-term trend, but prices for services—the stickier portion of the consumption basket—have yet to normalise. The firmer outlook for growth has contributed to a reacceleration in service prices over the last three months, as inflation momentum has broadened across countries and sectors, which could see inflation expectations raised.

Although wage growth remains elevated, we expect pay growth will moderate given forward-looking indicators of wage setting and a softening of the labour market. We expect headline inflation to return to target (2%) by year-end in the euro area and, despite hitting 2% in May, UK headline inflation is not expected to settle at that level until the first quarter of 2025 in the UK. Core inflation, which excludes volatile items like food and energy, likely won’t return to target in each region until the first quarter and second quarter of 2025, respectively.

On the policy front, the ECB has moved first in commencing the easing cycle, with a cut of 25 basis points (0.25 percentage points) this month. We expect similar cuts at a quarterly cadence, with two more coming this year and four next year, which would leave the policy rate at 2.25% at the end of 2025.

The BoE is in a similar situation, with its first cut likely to come in August. Thereafter, we expect the Bank Rate to be cut by an additional 25 basis points before the end of this year, then further cuts next year totalling one percentage point, bringing the rate to 3.75% by the end of 2025. However, risks skew toward less easing for both central banks, as pressures from services prices may push policymakers to take a more cautious approach.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in EEA by Vanguard Group Europe Gmbh, which is regulated in Germany by BaFin.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.

© 2024 Vanguard Group Europe GmbH. All rights reserved.