- Small-cap equities can play a valuable role in global portfolios, adding diversification in terms of market cap, country and sector exposure.

- The valuation discount for small-caps relative to the broader market is the highest it has been for 20 years, providing a tailwind for growth for investors considering the exposure1.

- From a cost and performance perspective, index investing has proven to be an effective way to access small-cap equities in recent years.

Small-capitalisation equities have increasingly been on investors’ minds in recent months, with the valuation discount to the broader market at its highest for 20 years2. With various building blocks available to investors, choosing an appropriate small-cap equity exposure can help to enhance diversification and growth for a global portfolio.

Exposure to small-sized companies, predominantly in developed markets, is often overlooked in favour of larger, more established companies. However, given global small-caps’ risk-adjusted return appeal, coupled with significant valuation discounts, they can be an attractive option for investors looking to enhance their portfolio's performance as stagflation fears dissipate.

Diversification and the mitigation of concentration risk

Core beta equity portfolios have become increasingly concentrated in large-cap stocks in recent years. Including global small-caps in an investment portfolio can help to enhance diversification, as small-cap exposures tend to be less concentrated than large-caps. By more evenly distributing investments across a variety of companies spanning different sectors and countries, adding small-caps to a portfolio can mitigate the impact of volatility in any single market or sector, reducing lopsided valuation risk.

If we compare the MSCI World Index with the MSCI World Small-Cap Index, we can see the high level of diversification small-caps offer, both in terms of reduced top-level concentration and a greater number of index holdings. Consider how the top 10 holdings represent almost 24% of the MSCI World Index, despite the index holding a total of 1,429 constituents3. In the MSCI World Small-Cap Index, however, the top 10 holdings account for only 1.75% of an index with 4,043 constituents in total.

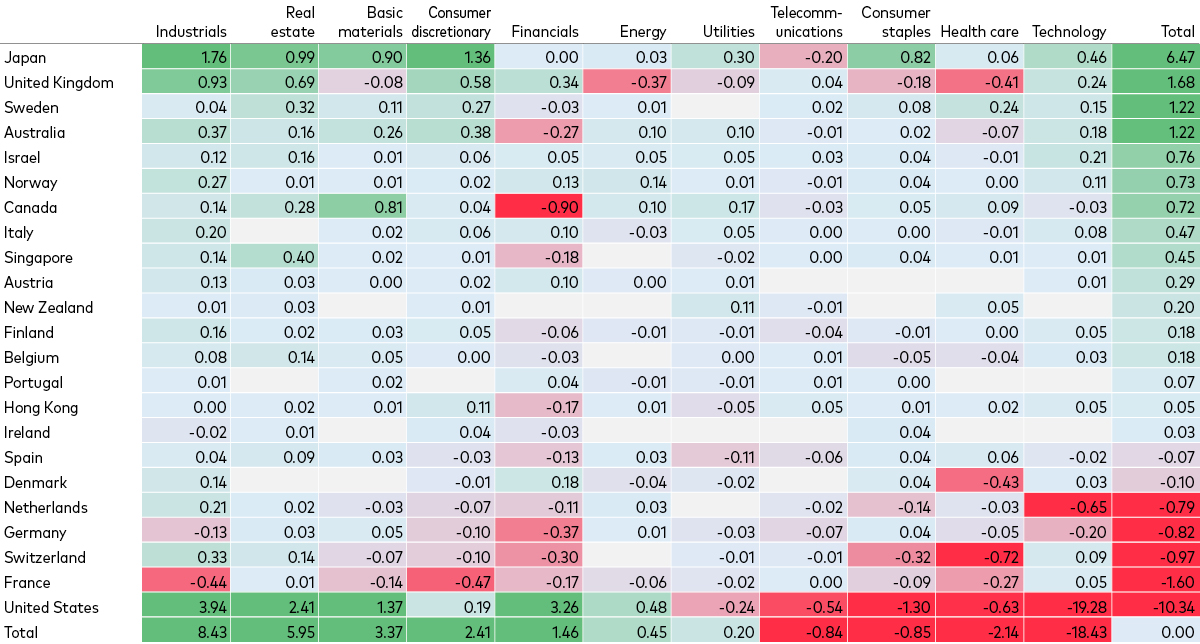

We also see meaningful differences in sector and country weightings between these indices. Comparing the MSCI World Index with the MSCI World Small-Cap Index, the small-cap exposure has a greater weighting to Japan and the UK while having a lower weighting to the US than the large-cap benchmark (although the US is still the largest country exposure in the small-cap index). The small-cap index also has a lower weighting to technology stocks and a greater weighting to industrials and real estate than the large-cap index. The table below offers a full picture of how the small-cap exposure compares, from a net weighting perspective for both countries and sectors, against the MSCI World Index.

Lower US tech weighting, increased Japan exposure

MSCI World Small-Cap Index net of MSCI World Index holdings, by country and sector (net weight, %).

Source: FactSet, as at 31 July 2024. Data derived from constituents of the MSCI World Small-Cap Index and the MSCI World Index.

From a total return perspective, investors in global small-cap companies have also benefitted from dividends in the past 18 years4. So for investors who might be looking to complement portfolio exposures that have seen significant price appreciation, small-caps offer an additional diversification angle if we assume dividends remain consistent going forward. Such an income stream enhances the resilience of the total return proposition, making it well-suited to withstand economic fluctuations.

Broad valuation discounts

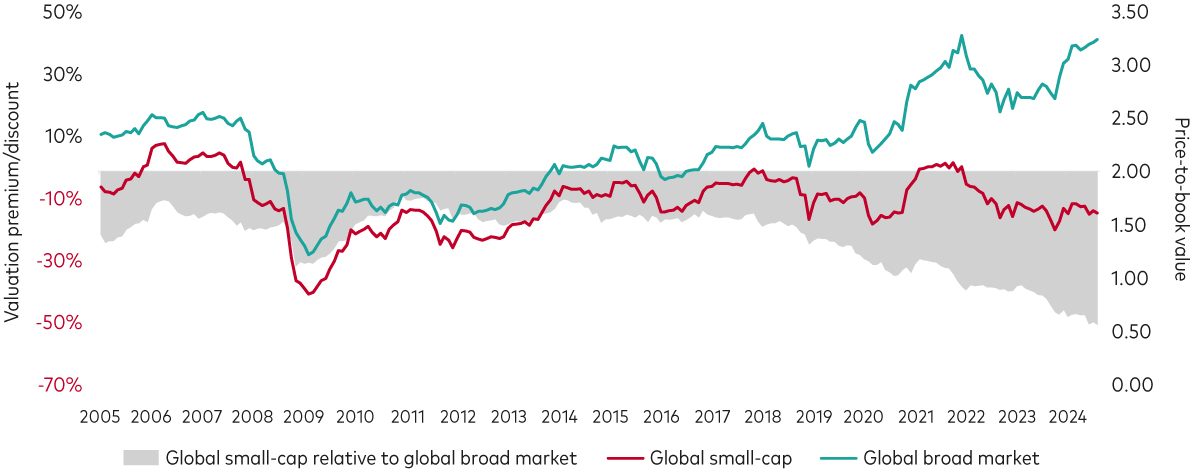

Small-cap equities have consistently traded at a discount (as measured by price/book value) to the broader equity market, going back decades. From 2018 onwards, however, the valuation gap has been expanding. Currently, the valuation discount for global small-caps has reached a level not seen in the past 20 years, as the chart below illustrates.

Small-cap valuations have become more attractive relative to the broad equity market

Absolute and relative valuations for global equities

Source: FactSet. Data from 31 July 2005 to 31 July 2024. Indices referenced are MSCI World Small-Cap Index and the MSCI World Index.

Looking at the broader equity market, the valuation change has been driven mainly by large- and mega-cap companies, particularly in the information technology sector, along with those in the consumer discretionary and communication services sectors. Because small-caps are more domestically focused, and struggle under tighter monetary conditions, they have not participated in the recent cash-rich, global mega-cap rally and valuations have therefore lagged larger companies.

We believe small-cap equity exposure can serve as a valuable building block in a portfolio. The discounts we see indicate that small-caps are undervalued relative to their larger counterparts, offering a tailwind for growth in the event the global economic climate improves and monetary conditions ease. Current valuations make the case for including global small-cap exposures in portfolios even more appealing for those investors aiming to diversify their investments.

Gaining small-cap exposure through index implementation

For investors considering an allocation to global small-caps, index funds can be an effective way to access the asset class. Importantly, through an index vehicle, investors can gain low-cost exposure to a small-cap universe – even when the universe is a complex, globally diversified index such as the MSCI World Small-Cap Index. An index fund with a low TER and consistently low tracking error can provide investors with the best chance for long-term investment success.

An index approach also compares favourably against active management in the small-cap space, in the aggregate. Based on Morningstar data, over the past 15 years, 85% of US small-cap active funds have underperformed their benchmarks, while 87% of European small-cap active funds have underperformed5. Moreover, for US and European small-cap managers, the asset-weighted annual average underperformance for the same period has been 1.2% and 0.7%, respectively. There is a further issue of survivorship: only 35% of actively managed US small-cap funds made it through the 15-year period under consideration; for European small cap managers, the figure was 41%.

Vanguard’s low-cost, consistent implementation for small-cap index exposure offers an attractive alternative, providing investors with an effective way to tap into the potential of small-cap stocks.

A strategic component for diversified portfolios

With their compelling diversification benefits, as well as the current valuation discounts on offer, global small-cap stocks can enhance a global equity portfolio's risk-adjusted performance. The specific characteristics of small-caps, combined with effective, low-cost index fund implementation, make them an important building block for equity investors.

1Source: FactSet, as of 31 July 2024. The valuation metric used here and throughout this article is price/book.

2Here small-cap equities refers to the MSCI World Small-Cap Index and the broader market is represented by the MSCI World Index.

3Source: FactSet, as of 31 July 2024.

4Source: FactSet, data for the period 31 May 2006 to 31 July 2024. During that period, dividends accounted for approximately one-third of the total return of developed market small-cap equities (MSCI World Small-Cap Index).

5Source: Morningstar Active/Passive Barometer, as at year-end 2023.

Related funds

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in EEA by Vanguard Group Europe Gmbh, which is regulated in Germany by BaFin.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.

© 2024 Vanguard Group Europe Gmbh. All rights reserved.