- US equities have been driven by strong earnings growth and increasing price/earnings ratios in recent years.

- Meanwhile, earnings growth in many markets outside the US has stagnated since 2010.

- There is a growing tension between momentum and overvaluation; ultimately, high starting valuations will drag long-term returns down and dominate returns.

Replicating the past decade’s stellar returns is not an easy feat - it would require unprecedented earnings growth, historically high valuations or a US dollar that continues to appreciate significantly.

Investment Strategy Analyst, Vanguard Europe

US equities have delivered strong returns in recent years and 2024 was no exception. Over the past decade, US equities have delivered an astounding 14.8% annualised return, far outpacing global ex-US equities (7.0%) and euro area equities (7.8%)1.

The market has been increasingly concentrated in growth-oriented sectors, such as technology, which support higher valuations. However, while valuation expansion and the technology sector have attracted attention in the US, broad earnings growth (primarily driven by revenue) has dominated US outperformance.

Conversely, earnings growth in many non-US markets has stagnated since 2010, and a strengthening US dollar further added to returns from investments in the US market. The question is - does the bumper performance of US shares reflect rational or irrational exuberance?

A growing point of tension

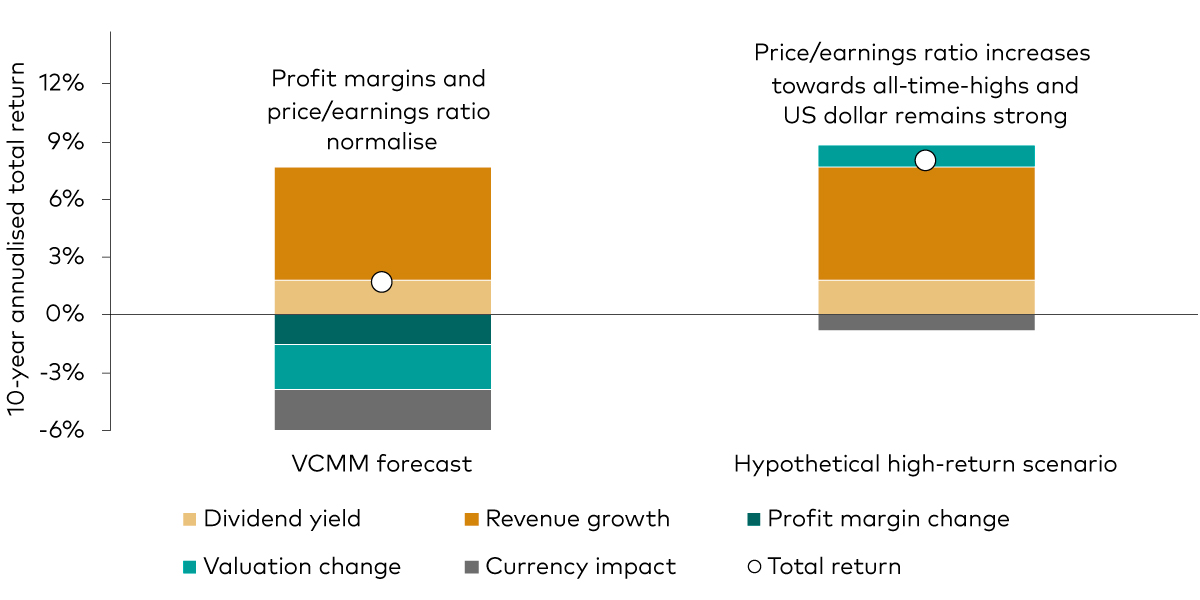

Replicating the past decade’s stellar returns is not an easy feat - it would require unprecedented earnings growth, historically high valuations or a US dollar that continues to appreciate significantly. This is not impossible, although profit margins and valuations at or close to record highs and a US dollar that has had one of the strongest runs in 50 years2 have set a high bar.

Extreme circumstances will be needed for US equities to repeat the last decade’s performance

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Notes: The chart shows the current Vanguard Capital Markets Model (VCMM) 10-year annualised return forecast for US equities in EUR and decomposes the forecast into its components: dividend yield, revenue growth, profit margin change, valuation change and currency impact. The second bar shows a hypothetical alternative scenario to illustrate the extreme circumstances needed for US equities to return 8% over the next decade

Source: Vanguard calculations, as at 8 November 2024.

IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class. Simulations are as at 8 November 2024. Results from the model may vary with each use and over time.

While valuations are high and, in our view, will likely fall, the question is when and by how much. There is a growing tension between momentum and overvaluation, leaving the regions with the strongest recent performance more expensive than others.

History shows that, absent an economic or earnings growth shock, equity market returns can continue to defy their valuation gravity in the near term. But, ultimately, high starting valuations will drag long-term returns down and dominate returns as a “fundamental gravity”.

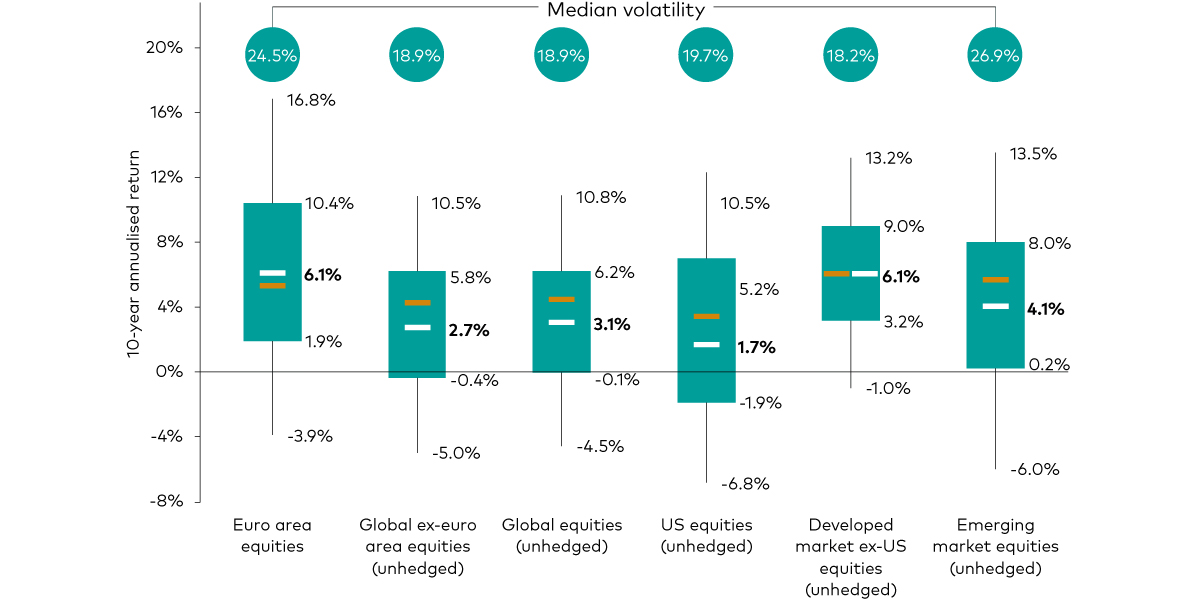

A falling price/earnings ratio is a key component of our long-term US equity return forecast with a median of 1.7%. While this may appear cautious, valuations are rarely a good timing tool and there remains a 30% probability for the US to outperform global ex-US equities, though by a narrower margin than in recent years.

Long-term value in non-US equity markets

Looking beyond the US, valuations are more attractive. However, it could be some time before that materialises in higher investment returns, as these economies are likely to be the most exposed to rising global economic and policy risks. This is particularly true for the euro area and emerging markets, where the price/earnings ratio is low but intensifying trade tensions pose a challenge.

Additionally, in many non-US markets, dividends play a bigger role as both a source of income and as a potential performance compounder over the long term. It is important to remember that dividends are a key component of total returns, even in periods of smaller stock price growth.

Compared with last year’s Vanguard economic and market outlook, we expect slightly lower returns for US equities, with a median 10-year annualised forecast of 1.7%, while our outlook for euro area equities has improved, to around 6.1%. For global ex-euro area and global equities—which contain a large allocation to the US—we expect returns of around 2.7% and 3.1%, respectively. For developed market ex-US equities, we expect returns to be around 6.1%, reflecting the more attractive valuations outside the US market that we expect to matter in the long term.

Markets outside the US to offer higher long-term expected returns

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Notes: The forecast corresponds to the distribution of 10,000 VCMM simulations for 10-year annualised nominal returns in GBP for assets highlighted here. Median volatility is the 50th percentile of an assets class's distribution of annualised standard deviation of returns. The median 10-year annualised nominal returns as at the end of last year are shown by the brown bars. Asset-class returns do not take into account management fees and expenses, nor do they reflect the effect of taxes. Returns do reflect the reinvestment of income and capital gains. Indices are unmanaged; therefore, direct investment is not possible. Benchmarks used for asset classes: UK equities: MSCI UK Index; Global ex-UK equities: MSCI AC World ex-UK Index; Global equities: MSCI AC World Index; US equities: MSCI US Broad Market Index; Developed market ex-US equities: MSCI World ex-USA Index; Emerging market equities: MSCI EM Index.

Source: Vanguard calculations, based on data from Refinitiv, as at 8 November 2024.

IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class. Simulations are as at 30 September 2023 and 8 November 2024. Results from the model may vary with each use and over time.

Taking advantage of the AI transformation

High market concentration in the US means that several large growth companies are dominating the S&P 500 Index (in fact, the six largest companies in the index currently account for about 30% of its overall market capitalisation[1]). These companies have driven developments around artificial intelligence (AI) which has recently helped to propel US equity valuations to multi-decade highs.

While our research suggests that AI likely will be positive for the entire economy, that doesn’t mean investors should overweight technology stocks in their portfolios. Instead, we expect the tug-of-war between productivity improvements thanks to AI and rising fiscal deficits due to rising, age-related government spending to affirm the value of value-oriented stocks such as health care or financials.

If we see a broadening out of productivity improvements across the economy, we expect profitability to improve across sectors and value stocks could come into favour and outperform the broader equity market, after a long period of underperformance. Instead, if AI disappoints, the growth expectations reflected in the high valuations of technology stocks could be too hard to meet and valuations return to lower levels, while cheaper value-oriented stocks might face fewer headwinds.

A diversified exposure across global equity markets offers a reasonable positioning for either scenario, without the risk of missing out on investing in the best-performing sectors or regions of the future.

1 As measured by the S&P 500 Index, the MSCI ACWI ex USA Index and the MSCI Economic and Monetary Union (EMU) Index, from 30 September 2014 to 30 September 2024. Vanguard calculations in EUR, based on data from Refinitiv, as at 8 November 2023.

2 After reaching its lowest point on 22 April 2008 in its history going back to 4 January 1971, the ICE U.S. Dollar Index (DXY) increased by more than 50% up until 18 December 2024. This is only rivalled by the similarly-sized increase from 1992 until early 2000, or an even larger increase between 1980 and the mid-1980s.

3 Source: Vanguard calculations based on data from Refinitiv, as at 18 December 2024. The six largest companies in the S&P 500 Index represent 7.0% (Apple), 6.6% (NVIDIA), 6.1% (Microsoft), 3.8% (Amazon.com), 2.4% (Meta Platforms) and 1.9% (Alphabet) respectively of the index’s market capitalisation.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

The primary value of the VCMM is in its application to analysing potential client portfolios. VCMM asset-class forecasts—comprising distributions of expected returns, volatilities, and correlations—are key to the evaluation of potential downside risks, various risk–return trade-offs, and the diversification benefits of various asset classes. Although central tendencies are generated in any return distribution, Vanguard stresses that focusing on the full range of potential outcomes for the assets considered, such as the data presented in this paper, is the most effective way to use VCMM output.

The VCMM seeks to represent the uncertainty in the forecast by generating a wide range of potential outcomes. It is important to recognise that the VCMM does not impose “normality” on the return distributions, but rather is influenced by the so-called fat tails and skewness in the empirical distribution of modeled asset-class returns. Within the range of outcomes, individual experiences can be quite different, underscoring the varied nature of potential future paths. Indeed, this is a key reason why we approach asset-return outlooks in a distributional framework.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This is a marketing communication.

This is directed at professional investors and should not be distributed to or relied upon by, retail investors.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.